Since May, due to significant price manipulation, articles about borrowing coins from whales have started to be published. However, I have been monitoring the borrowing whale data since March.

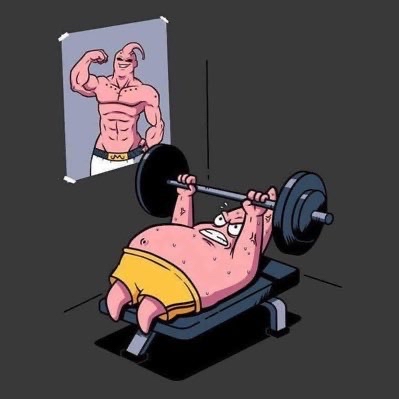

As shown in the attached image, here are my thoughts:

From the data showing that borrowing whales are using specific exchanges to borrow coins, it can be seen that in March, the maximum borrowable amount on the platform was 9.1 million PI,

As of now, the borrowable amount has decreased to a maximum of only 5.85 million (LTV=35.63%).

However, from the price trend, when a whale borrows more than 4 million at once, it has already caused a crash, not to mention that the initial borrowing of USDT to buy PI led to a sell-off exceeding 9 million. This made the market price completely unsustainable.

Based on the borrowing formula "Borrowable Amount = Total Value of Staked Assets × Initial Staking Rate," we can determine the borrowable amount.

Based on the highest borrowing on the 22nd reaching 9.8 million PI, the platform usually has an LTV of 65%, but the corresponding LTV for the borrowable amount is only 35.63%, indicating that the CEX has reduced the maximum borrowable amount.

Therefore, it can be concluded that this CEX platform has determined that the risk of borrowing PI has increased, thus lowering the maximum borrowable amount, as the LTV is below the publicly available data.

※ However, this also means that the staking amount of CEX users is now much higher than the total amount of about 100 million in March. This indicates that most people are completely unaware that staking is causing the borrowing whales to suppress prices. ※

Because the current total amount on CEX is 30 million, but the calculated staking amount has reached 26 million. CEX itself has run out of PI, which is why the borrowable amount has decreased.

Therefore, most investors do not care whether they are being borrowed from; they just want to earn that 1% interest and want to lie flat. Then, when they see whales borrowing and suppressing prices, they come out to complain.

It can be seen that most people are supporters of borrowing whales. It seems that most people like borrowing whales, so let’s suppress PI to 0.1; there should be no objections, right?

Those who oppose, please give a ❤️, and let’s see that the number of opponents should be very few.

#PI

Are you all feeling very annoyed by the borrowing whales of pi?

Let me report something to all investors!

Historically, these borrowing whales have only borrowed on specific exchanges. Moreover, historically, the whales have borrowed up to a maximum of 11 million pi from the exchange.

Now we can see that the borrowing data has reached 9.8 million today. Based on the historical maximum funding amount, there are at most 2 million pi left to borrow.

Looking back, the last time 11 million pi was borrowed was on August 1, which caused a rapid drop to nearly 0.7.

At that time, there might have been a lack of funds and an urgent need to repurchase pi, which then surged to 0.46. 0.46 not only exceeded the whales' repurchase cost, but the whales also lost nearly 50% due to suppressing the price difference.

Now, please pay attention, the borrowing whales have already borrowed up to 9.8 million pi. According to history, they have at most 3 million in funds left, and even with 3 million, they can only suppress the liquidity price difference by 0.02 at most.

Moreover, the total amount on that exchange is only 30 million pi, and not all of it is available for borrowing, which means that borrowing has already reached the limit.

Therefore, now is the time to fight against the whales. As long as investors intentionally raise the price, there is no need to buy more; just keep intentionally raising the price, and when the borrowing whales get scared, they will quickly repurchase 5 million pi to help investors push the price up, just like last time.

What do you all think about the current situation? I urgently need to hear the opinions of all the big players!

13.43K

9

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.